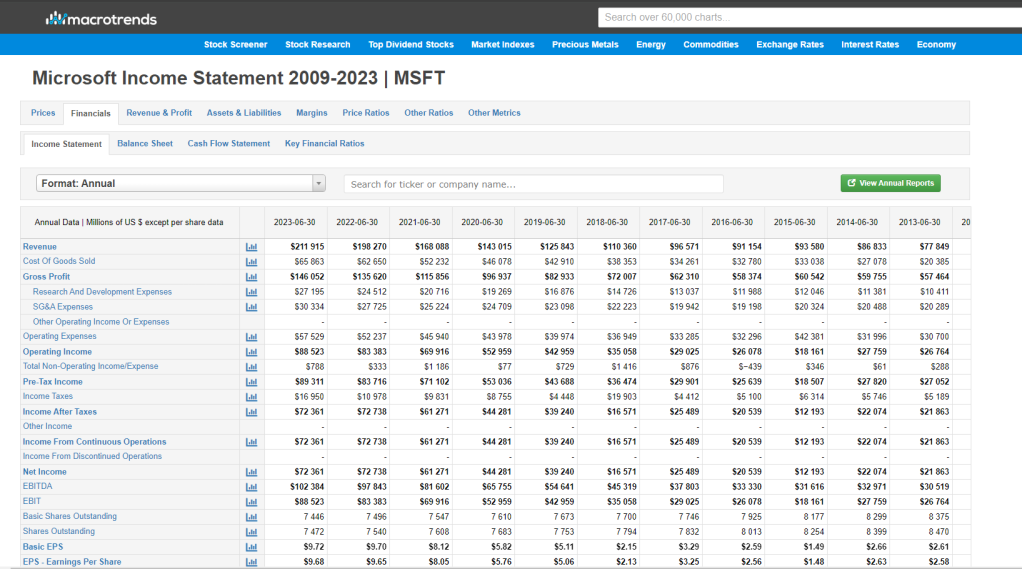

Fundamental analysis of stocks is to analyze the historical financial numbers of a company to assess the quality and the price of a stock. The numbers are taken from the income statement, balance sheet, and cash flow statement.

There are no set rules on how you analyse a stock. Stocks in different industries and different types of stocks should be analyzed differently. So you must analyze a deep value stock differently than a high quality fast growing stock.

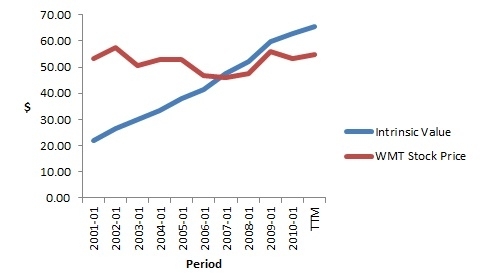

I will in this article go through important financial numbers that you should look for and calculate when you analyse a high quality company and why these numbers are important. The Warren Buffett Spreadsheet aim to identify high quality companies selling at an attractive price. Attractive price is when the estimated intrinsic value is lower than current market price.

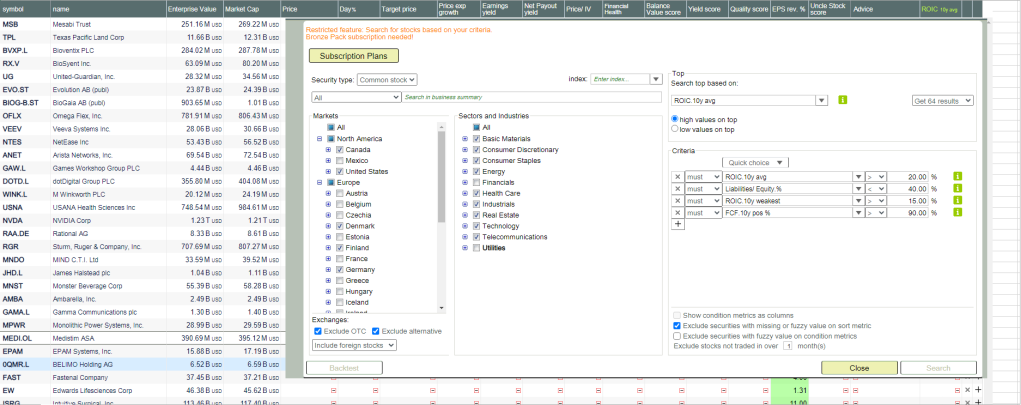

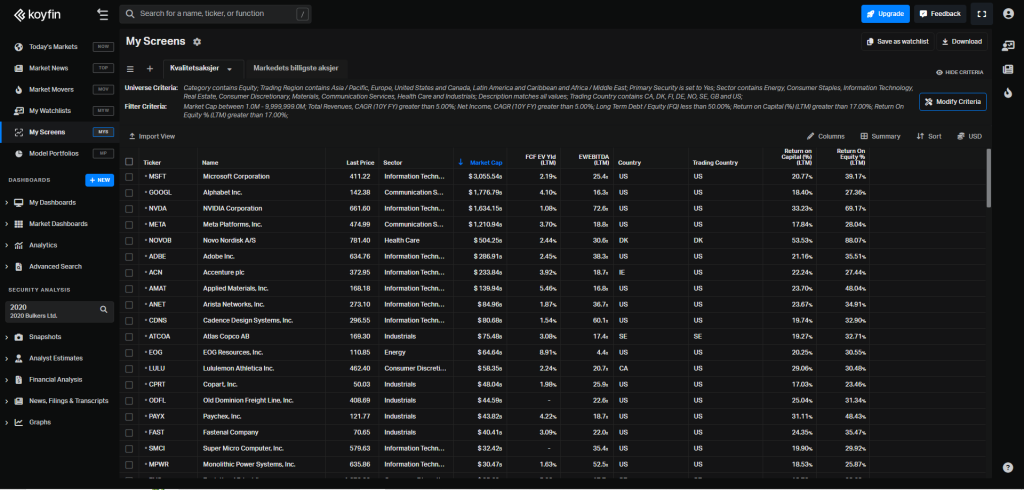

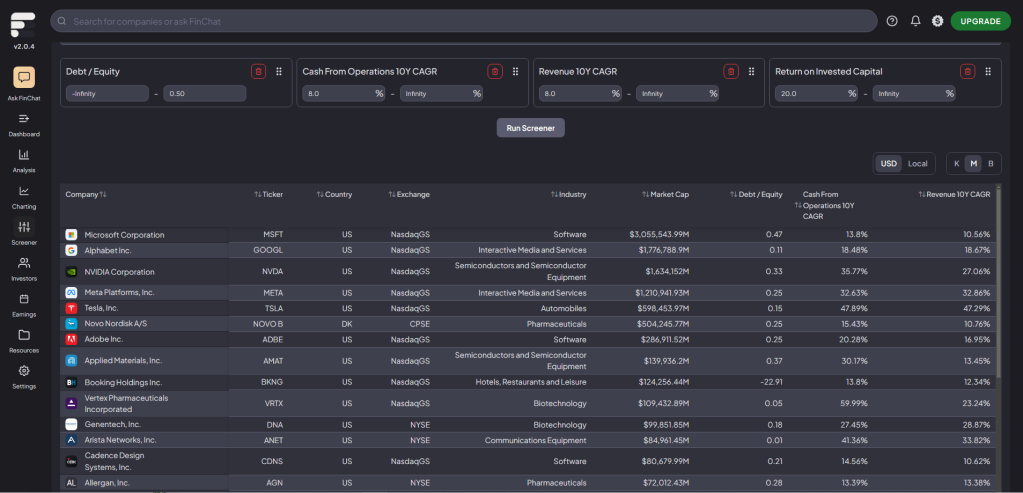

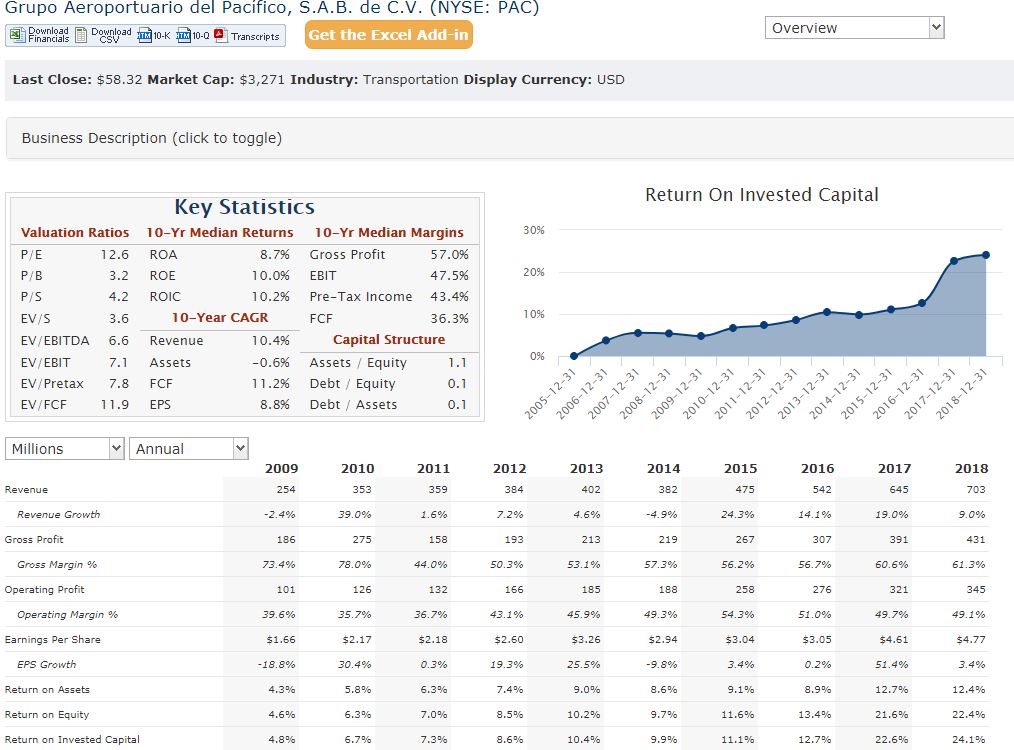

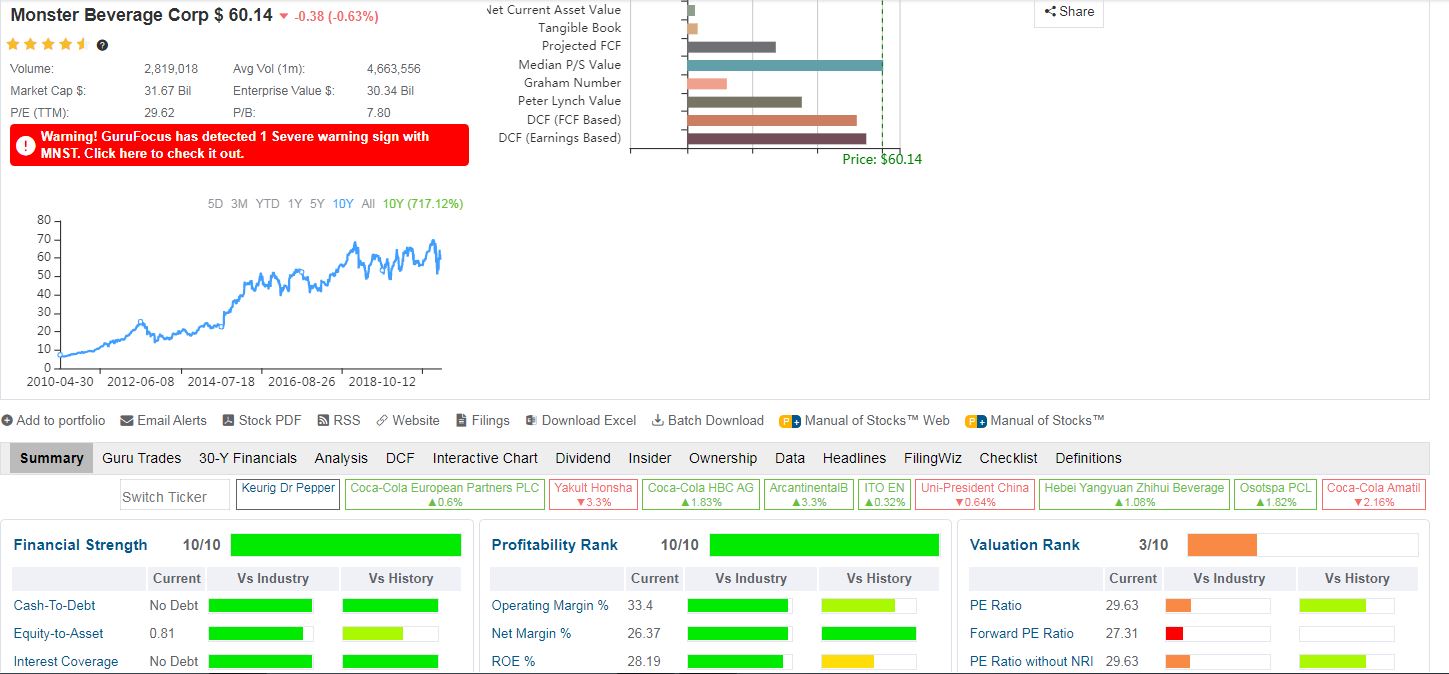

When you analyse a high quality company you should always try to get at least 10 years of historical financial data. If you can find even longer period the better. You can use morningstar.com and gurufocus.com for getting the important financial data.

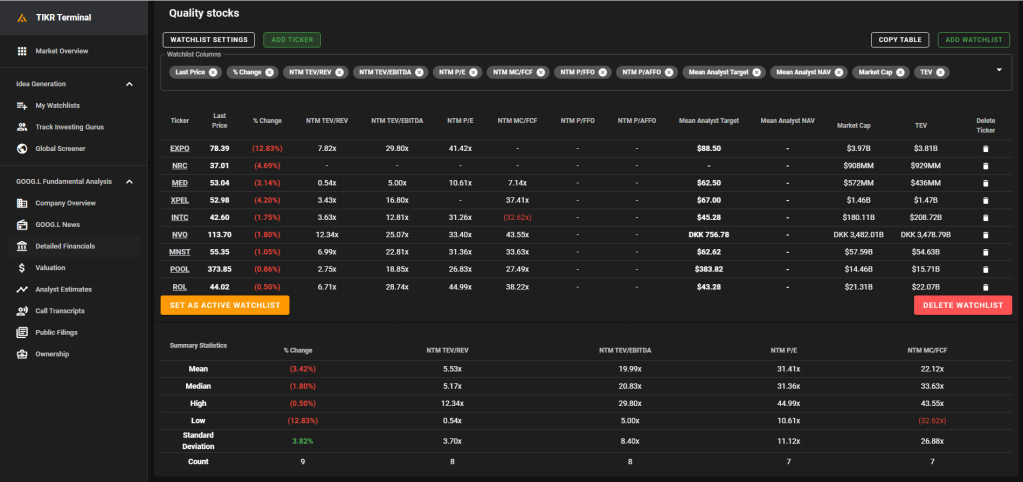

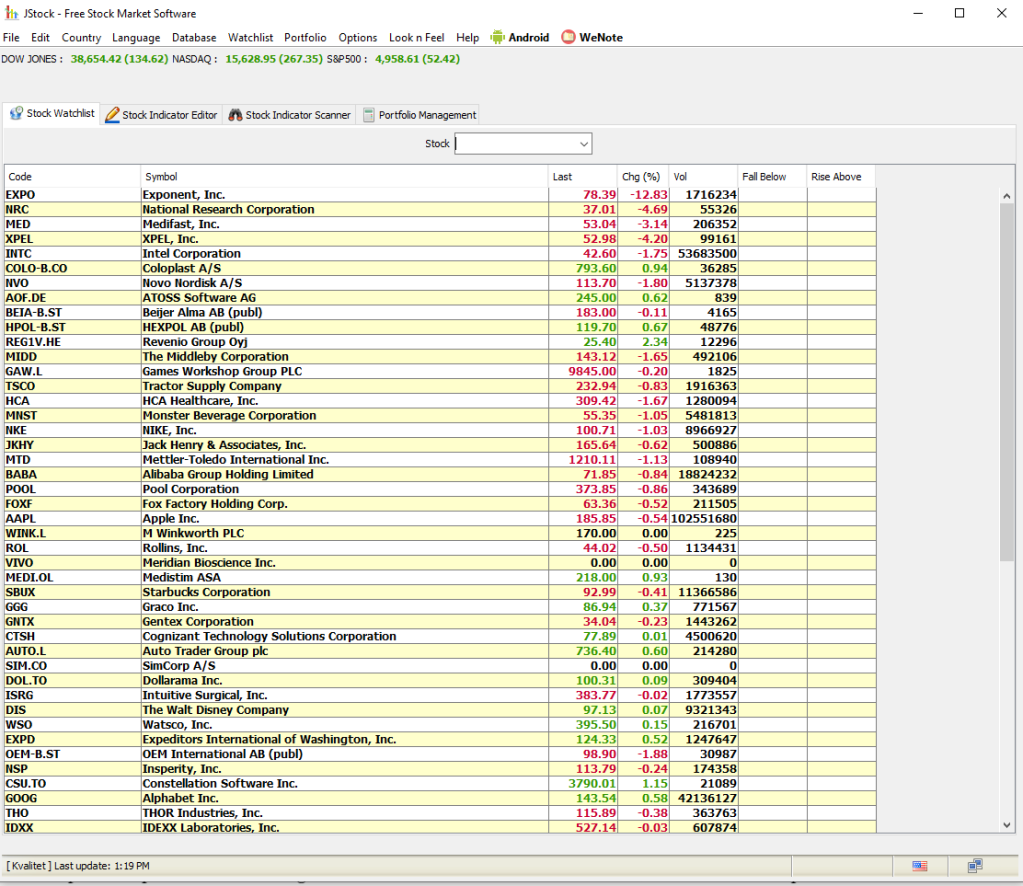

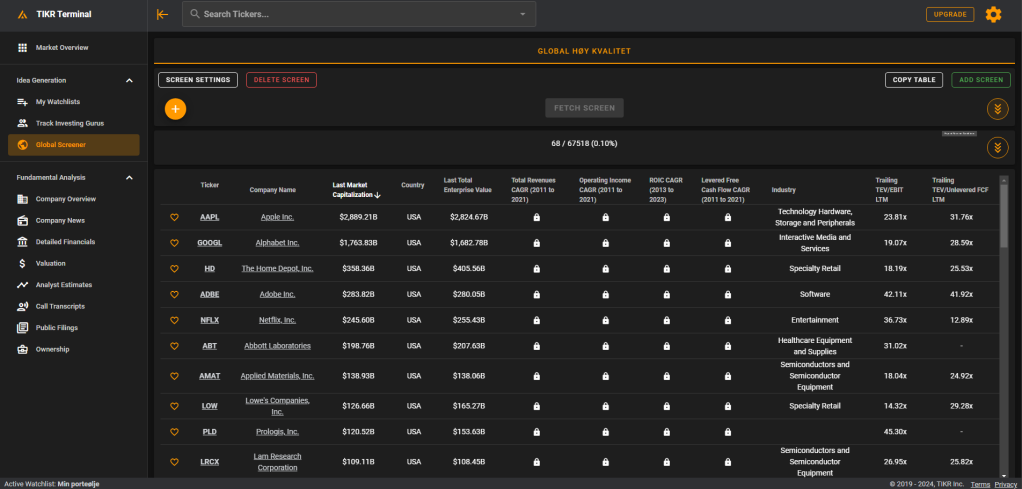

Also QuickFS and TIKR are newcomers that also provides great overview of a stocks fundamental data

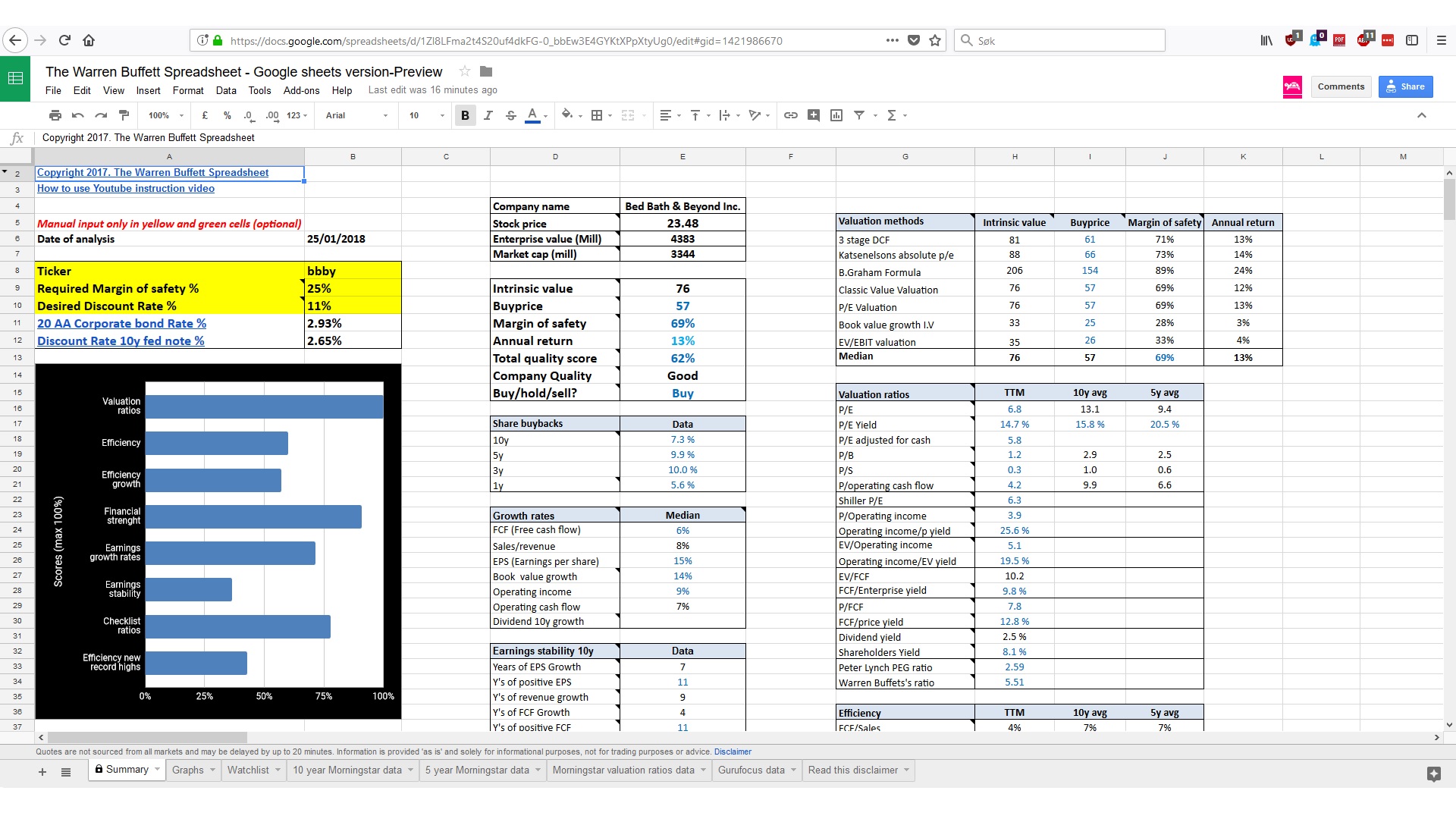

If you want even faster and better analysis of the fundamental data you can take a look at The Warren Buffett Spreadsheet. It will automatically import the financial data into a spreadsheet and do all the calculations for you in a few seconds.

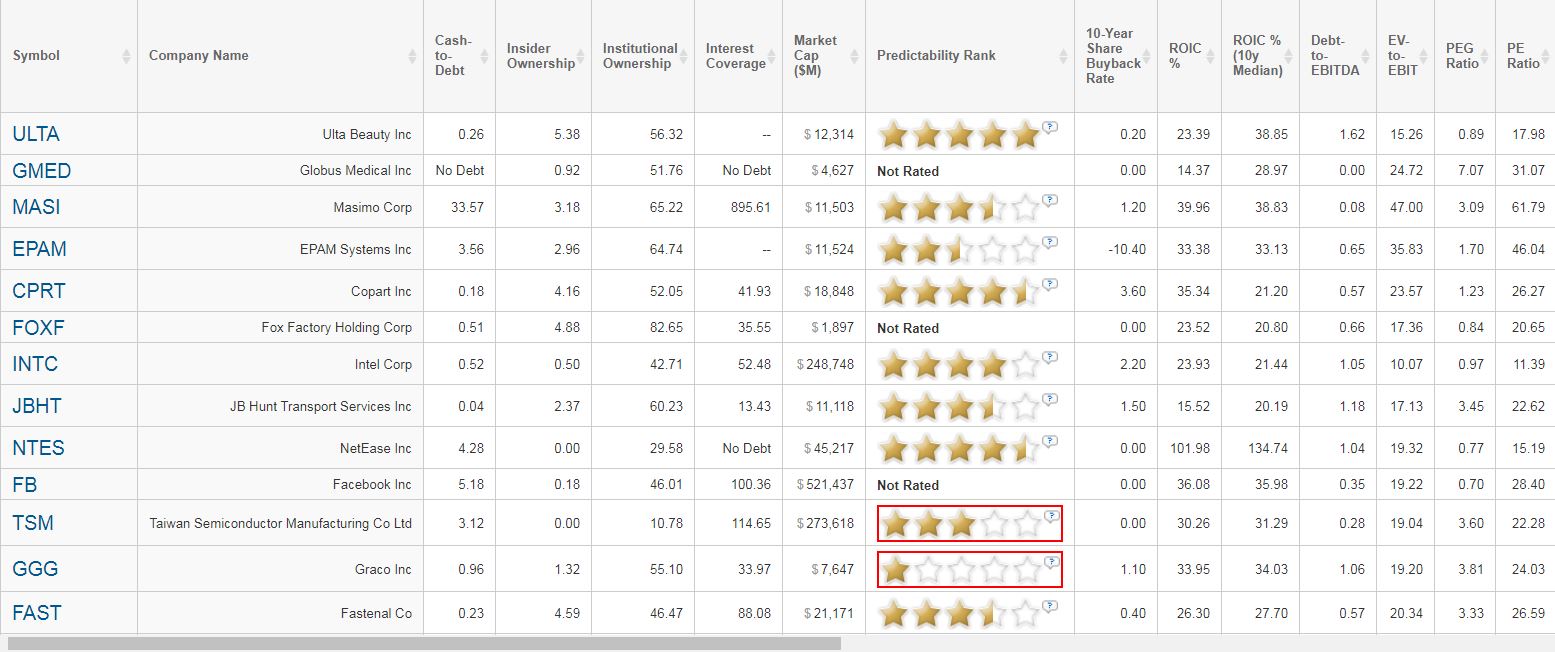

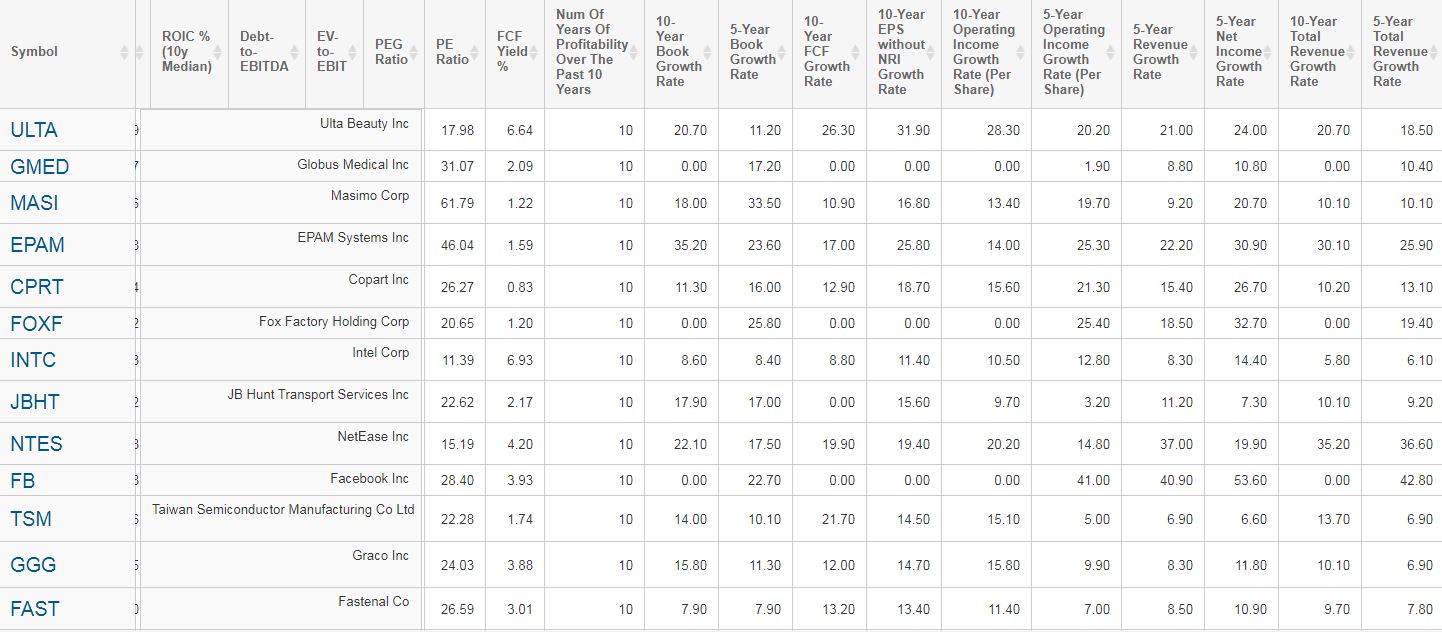

So let’s go through the financial numbers that I recommend you to analyse to assess the quality of the company. Remember to always look at the average or median over a 10 year period for the financial data. You want the longest dataset you can so that you can more easily determine how predictable and stable the earnings for the company is. Longer history of data will also reveal how the company handled recessions in the economy and will reveal how cyclical the earnings are.

With the key numbers I mention here, always look for stability in the numbers, the less fluctuation from year to year the better.

Here is an example of a company I think fulfill most of the quality targets that I have outlined below:

The stock is FAST and the company name is Fastenal Co

“Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, North America, and internationally. It offers fasteners, and related industrial and construction supplies under the Fastenal name. The company’s fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers, which are used in manufactured products and construction projects, as well as in the maintenance and repair of machines. It also offers miscellaneous supplies and hardware, including pins, machinery keys, concrete anchors, metal framing systems, wire ropes, strut products, rivets, and related accessories. The company serves the manufacturing market comprising original equipment manufacturers; maintenance, repair, and operations; and non-residential construction market, which includes general, electrical, plumbing, sheet metal, and road contractors. It also serves farmers, truckers, railroads, mining companies, schools, and retail trades; and oil exploration, production, and refinement companies, as well as federal, state, and local governmental entities. The company distributes its products through a network of 3,268 in-market locations and 16 distribution centers. Fastenal Company was founded in 1967 and is headquartered in Winona, Minnesota.”

Company description from TIKR

Links to financial data:

https://financials.morningstar.com/ratios/r.html?t=0P0000023S&culture=en&platform=sal

https://www.gurufocus.com/stock/FAST

https://quickfs.net/company/FAST:US

I will compare this company numbers with my target numbers below.

Numbers for this company is from february 2021, so they may be different for this company when you read this article.

All data in tables below are from The Warren Buffett Spreadsheet

ROTC: Return on total capital

This is the net income the company is producing on its total capital ( total equity+debt) This shows the profitability of the company and how efficiently they are operating

If the company also can grow its ROTC over time it’s a sign of a strong company.

Target: above 12%

FAST: 26%! (10y median)

ROIC Growth rate: 0.1%

| PROFITABILITY |

2011-12 |

2012-12 |

2013-12 |

2014-12 |

2015-12 |

2016-12 |

2017-12 |

2018-12 |

2019-12 |

2020-12 |

TTM |

| Return on Invested Capital % |

26.1 |

27.8 |

26.9 |

25.6 |

23.2 |

22.4 |

24.2 |

28.7 |

26.4 |

26.1 |

26.1 |

| Efficiency growth rate |

Median 10y growth over different time periods. |

| ROTC |

0.1 % |

As you can see Fastenal has a high ROIC and stable ROIC which is a great sign.

Free cash flow/sales: (Free cash flow margin)

A measure on how efficient to company is translating is sales into FCF. A company with a avg value above 10% is very profitable and probably has a moat of some kind. A moat is a sustainable competitive advantage that makes it able to earn a high return in the future even with more competition from other companies. If the company also can grow its free cash flow of sales over time it’s a sign of a strong company.

Target: above 10%

FAST: 10% (10y median)

FCF/Sales growth: 9.0%

| Efficiency |

2011-12 |

2012-12 |

2013-12 |

2014-12 |

2015-12 |

2016-12 |

2017-12 |

2018-12 |

2019-12 |

2020-12 |

TTM |

| FCF Margin |

5% |

8% |

6% |

8% |

10% |

8% |

11% |

10% |

11% |

17% |

17% |

| Efficiency growth rate |

Median 10y growth over different time periods |

| FCF/Sales |

9.0 % |

As you can see Fastenal is fulfilling the target of 10% free cash flow margin. It has also been growing its free cash flow margin over the years which is another good sign that the company is operating at high efficiency.

Margins: Gross margins, operating margins, net profit margins:

In general you want to see positive and preferably high margins. You want to see high margins because that makes the company less fragile for losses compared to a company with razor-thin margins. However there are no absolute target for margins as companies in different industries has different margins. You want to see stability in the margins or even gradually increased margins. This is indications that the company has a moat.

FAST: Median numbers:

Target: Positive and stable margins. Preferably high margin numbers.

| Efficiency |

TTM |

10y avg |

5y avg |

| Gross margin |

46% |

49% |

48% |

| Operating margin |

20% |

21% |

21% |

| Net margin |

15% |

14% |

14% |

| Margins growth rate |

Median 10y growth over different time periods |

| Gross Margin |

-1.3 % |

| Operating margin |

-1.1 % |

| Net margin |

2.0 % |

As you can see it’s margins are high which is preferable.

Margin stability

Another measure to determine how predictable and stable a company’s earnings are.

Target: Less than 30% coefficient variation. This number shows how much the numbers are deviating from the average in % measured on a relative basis.

| Margin stability/Predictability |

Gross margins |

Operating margins |

Net margins |

Free cash flow margins |

ROIC |

| Min |

46% |

20% |

13% |

5% |

22% |

| Max |

52% |

22% |

15% |

17% |

29% |

| Average |

50% |

21% |

14% |

10% |

26% |

| Standard deviation |

2.0 % |

0.6 % |

0.9 % |

3.5 % |

1.8 % |

| Coefficient variation |

4% |

3% |

7% |

34% |

7% |

Its clear that the company has very stable margins. The free cash flow margin does not seem to be stable but the reason is that the FCF margin has been increasing the past 10 years which is a big positive.

Earnings growth:

Ideally you want to see a company that is growing its free cash flow, sales and net income over a 10 year period.

Target above 10 growth%

FAST: Median past 10 years:

Most important numbers in bold letters

| Growth rates |

Median 10 y growth over different time periods |

| FCF (Free cash flow) |

18% |

| Sales/revenue |

8% |

| EPS (Earnings per share) |

10% |

| Book value growth |

7% |

| Operating income |

7% |

| Operating cash flow |

13% |

| Dividend 10y growth |

13% |

The company is fulfilling the targets on most of the metrics. The most impressive is it’s growth in free cash flow.

Earnings stability:

I look for companies that has no negative EPS or free cash flow for the past 10 years. Also I like to see steadily growing sales and EPS. No negative EPS usually indicates that the company is not cyclical and a positive free cash flow can indicate that the company has plenty of cash to pay down debt, buying back shares, or paying a dividend to shareholders. Exceptions to this is for very fast growing companies, where the free cash flow can be negative for several years without indicating that the company has any problem. However I ideally prefer companies with a positive free cash flow the past 9/10 years, because they are generally more mature and stable than companies that has a several years with negative free cash flow.

FAST: Past 10 years:

Target: 9 of past 11 periods with a positive number and years of growth.

Most important numbers in bold letters

| Earnings stability 10y |

Data |

| Years of EPS Growth |

9 |

| Y’s of positive EPS |

11 |

| Y’s of revenue growth |

10 |

| Y’s of FCF Growth |

7 |

| Y’s of positive FCF |

11 |

| Y’s of dividend growth |

10 |

| Y’s of dividend paid |

11 |

| Y’s of oper. inc. growth |

9 |

| Y’s of pos.operating inc. |

11 |

| Y’s of O.C.F growth |

9 |

| Y’s of positive O.C.F |

11 |

Financial strength:

For high quality companies I am not so concerned about the D/E ratio. However I always take a look at the interest coverage ratio. This ratio show how many times the operating income can cover the interest payment on long-term loan. So a company can have a high D/E but a very strong sustainable cash flow which can easily cover the interest payment.

Targets (TTM):

Y’s to pay debt with net.Inc – Below 3 years

Y’s to pay debt with FCF – Below 5 years

Debt/Equity – Below 0.5

Current ratio – Above 1.5

Interest coverage – Above 5

Most important numbers in bold letters

| Financial strength |

TTM |

10y avg |

5y avg |

| Y’s to pay debt with net.Inc |

0.6 |

0.4 |

0.7 |

| Y’s to pay debt with FCF |

0.6 |

0.5 |

0.9 |

| Debt/Equity |

0.2 |

0.1 |

0.2 |

| Current ratio |

4.1 |

5.2 |

5.1 |

| Interest coverage |

117.8 |

158.1 |

98.5 |

Fastenal has a solid financial strength. Very low debt and the income from it’s business can easily cover their debt and debt interest.

Capex requirements: (capital expenditures):

Capex of operating cash flow (10 year average)

This is a ratio that checks how capital-intensive the company is. How much is use on capex in relation to its operating cash flow. In general a low capex company is more attractive than a high capex one.

Target is below 30%

FAST: 32%

Most important numbers in bold letters

| Checklist ratios |

TTM |

10y avg |

5y avg |

| Dividend safety |

1.5 |

1.8 |

1.6 |

| Net Inc of cash from operation |

111% |

103% |

100% |

| Dividend payout ratio |

59% |

58% |

63% |

| Capex of operating cash flow |

26% |

32% |

30% |

| Cum. capex of Cum. net inc |

|

30% |

26% |

Other important factors you should look for:

Shares outstanding:

You want to see a gradual decrease in shares outstanding over the past 10 years. It’s an indication that the management is shareholder friendly by buying back its own shares. This will increase the value of your shares as there will be fewer shares and the earnings per share will increase because of that. However you should figure out the timing of the companies buyback. If they did buybacks when the shares where cheap (Like in 2009) they are good at capital employment. However look out for companies that buy back shares when the company is expensive in relation to its intrinsic value. Also you don’t want to see companies that has massively increased its number of shares the past 10 years. In that case it’s likely that the shareholders ownership has been diluted.

Target: Reduced number of shares in the past 10 years.

FAST: 0.3% reduction. ( Positive number is good)

Most important numbers in bold letters

| Share buybacks |

Data |

| 10y |

0.3 % |

| 5y |

0.1 % |

| 3y |

-0.1 % |

| 1y |

0.0 % |

You want to invest in companies that has a management that is invested in the stocks themselves. So then their interest is aligned with your interest, and that is caring for the company and make sure the company is performing well. Skin in the game. No insider ownership and the management might not care too much on how the company perform, which is a disadvantage for you as an owner of the stock.Insider ownership:

Target: above 5% insider ownership

FAST: 0.3%

Source: https://finance.yahoo.com/quote/FAST/holders?p=FAST

The insider ownership should ideally been higher than what it is. But this is a fairly large company and this factor is not as important as it is for small and microcap stocks.

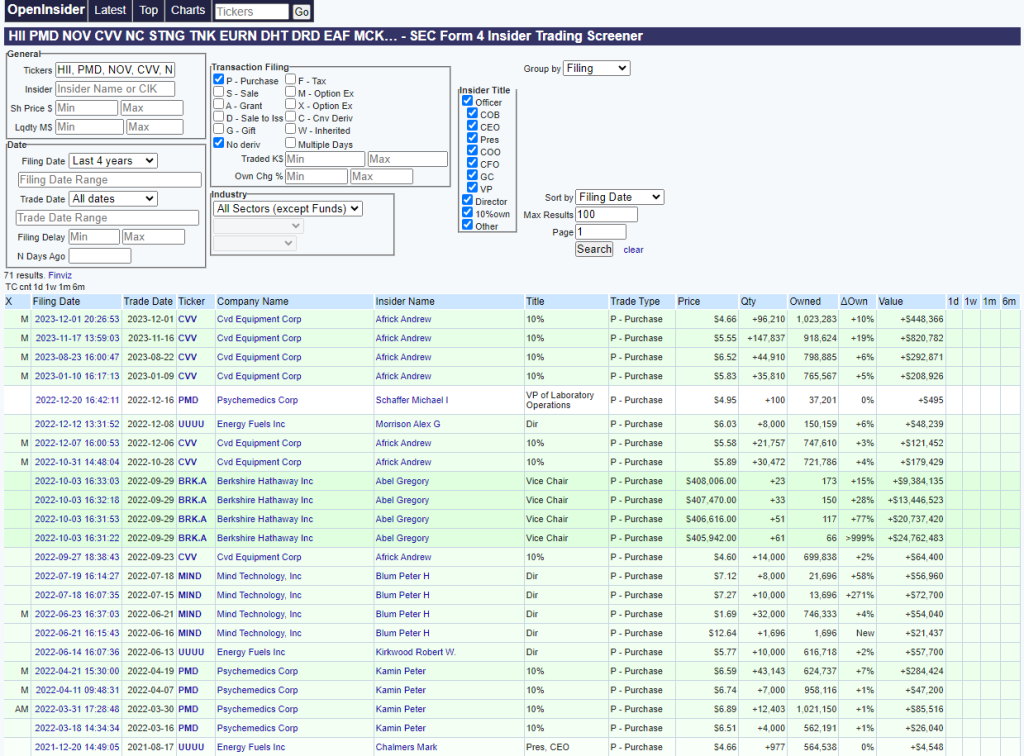

Insider buying:

When its comes to conviction and timing of buying this one is a strong indicator. If you see the management buying a lot of shares recently you can be sure that the management has a believe that the shares are undervalued and the future of the company is promising. Why else would they invest with their own money in the shares?

If you see many different people in the management buying and buying a lot of shares and in high percentage of their net worth it’s even better. On the opposite, if you see a massive amount of insider selling, you should be careful about the timing of your purchase or reconsider even buying the shares., there might be some big problems ahead for the company if you see many in the management unloading lots of shares.

FAST: Some recent insider buying, but nothing substantial

Source: Openinsider

Conclusion:

Fastenal is clearly a high quality company based on the numbers. It has a moat, and it’s likely that this company will show great probability also in the future. The stock price will in the long-term always catch up and reflect the fundamental performance of the company, so in the case of Fastenal Company the company has given the shareholders the following long term fantastic returns:

Past 20 years: +12371%

Past 10 years: +200%

Past 5 years: +117%

Past 1 year: + 24%

That makes an yearly annualized average return of 27.29%! Not too shabby for a “boring” stock like this.

(Numbers taken from gurufocus.com chart)

Remember that analysing the past 10 years of data is analysing the past! In investing its the future that matters. Sure the past 10 years of data will give you very valuable information about the quality of the company and there is a high chance that the good performance will continue, but you can’t be 100% certain of that. Because of that I recommend you also to read the companies annual reports to figure out if the company has a sustainable moat or not. A sustainable moat means there is some special characteristics of the companies that let its continue to earn a high return on its capital in the future even with increased numbers of companies entering the industry.

When you have found such a company, you need to wait and be patient until the company is sold at an attractive price in the market.

By the way, Fastenal looks fairly priced today (15.02.21) it does not seem to offer very attractive returns at the moment. The spreadsheet calculate it’s intrinsic value to be around 36$ as of today, compared to today’s stocks price of 47.39$. However keep in mind that this is a high quality company and you might be willing to pay up a bit for such a good company. You should consider buying a high quality company that is growing at a less discount to intrinsic value or less discount to average valuation multiples than a company that has less quality and growth.

| Stock Price |

47.39 |

| Intrinsic value |

36 |

| Buyprice |

27 |

| Margin of safety |

-30% |

| Total quality score |

71% |

| Company Quality |

Very good |

| Buy/hold/sell? |

Consider sell |

Looking at the multiples the past 10 years you can see that it’s rare for this company to be selling at a cheap price. People are aware of the quality and consistency of their earnings. But you can see that the stock was selling at a discount to their average multiples in 2015 and 2018 and in highsight we can see that it was attractive time to buy the stock.

Annualized average yearly return since:

2015: 14.1%

2018: 20.45%

| Past 10 years valuation |

2011-12 |

2012-12 |

2013-12 |

2014-12 |

2015-12 |

2016-12 |

2017-12 |

2018-12 |

2019-12 |

2020-12 |

TTM |

10 year average |

| P/E |

38.6 |

32.9 |

31.4 |

29.8 |

22.9 |

27.3 |

29.1 |

20.4 |

27.2 |

33.4 |

31.8 |

29.5 |

| P/B |

9.1 |

8.9 |

8.1 |

7.4 |

6.6 |

7.1 |

7.8 |

6.5 |

8.2 |

9.7 |

10.0 |

8.1 |

| P/S |

4.9 |

4.4 |

4.3 |

3.9 |

3.1 |

3.5 |

3.7 |

3.1 |

4.0 |

5.0 |

4.8 |

4.1 |

| P/Operating cash flow |

48.1 |

35.0 |

33.4 |

32.6 |

21.1 |

25.8 |

27.1 |

24.0 |

27.6 |

27.2 |

24.8 |

29.7 |

If the price of this company would drop because of a stock market crash or something similar that won’t permanently hurt the company it seems like a very solid company to consider buying at the right price.

Consider putting it on your watchlist for stocks to buy during a downturn or market crash!

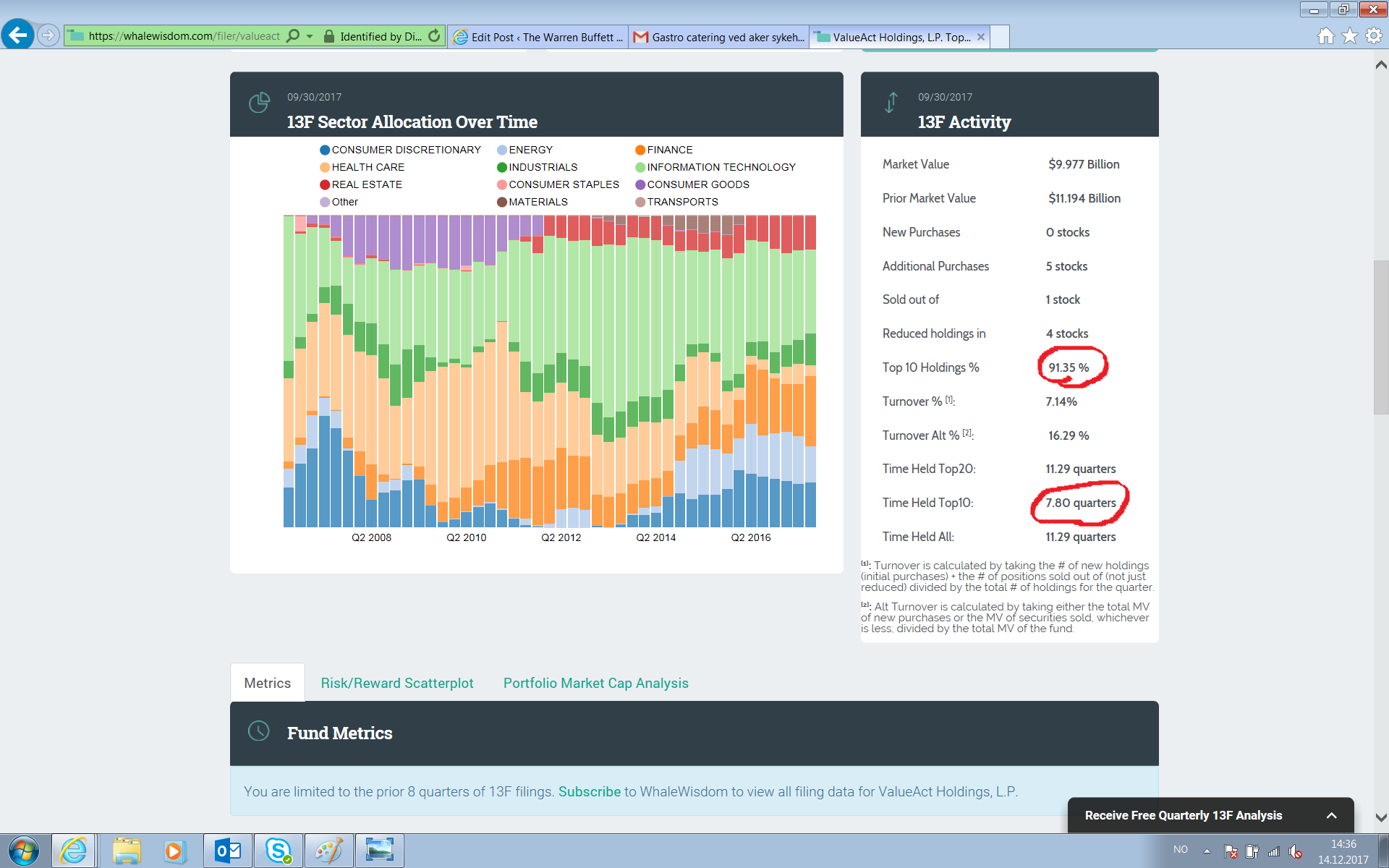

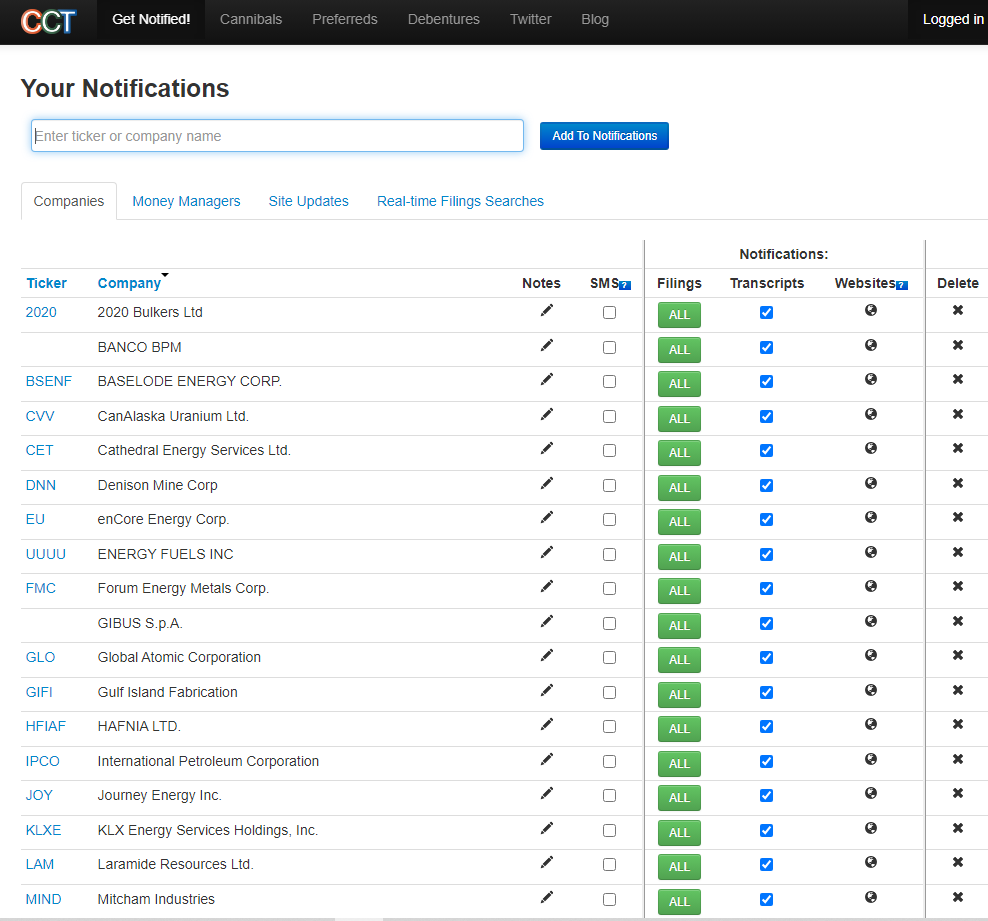

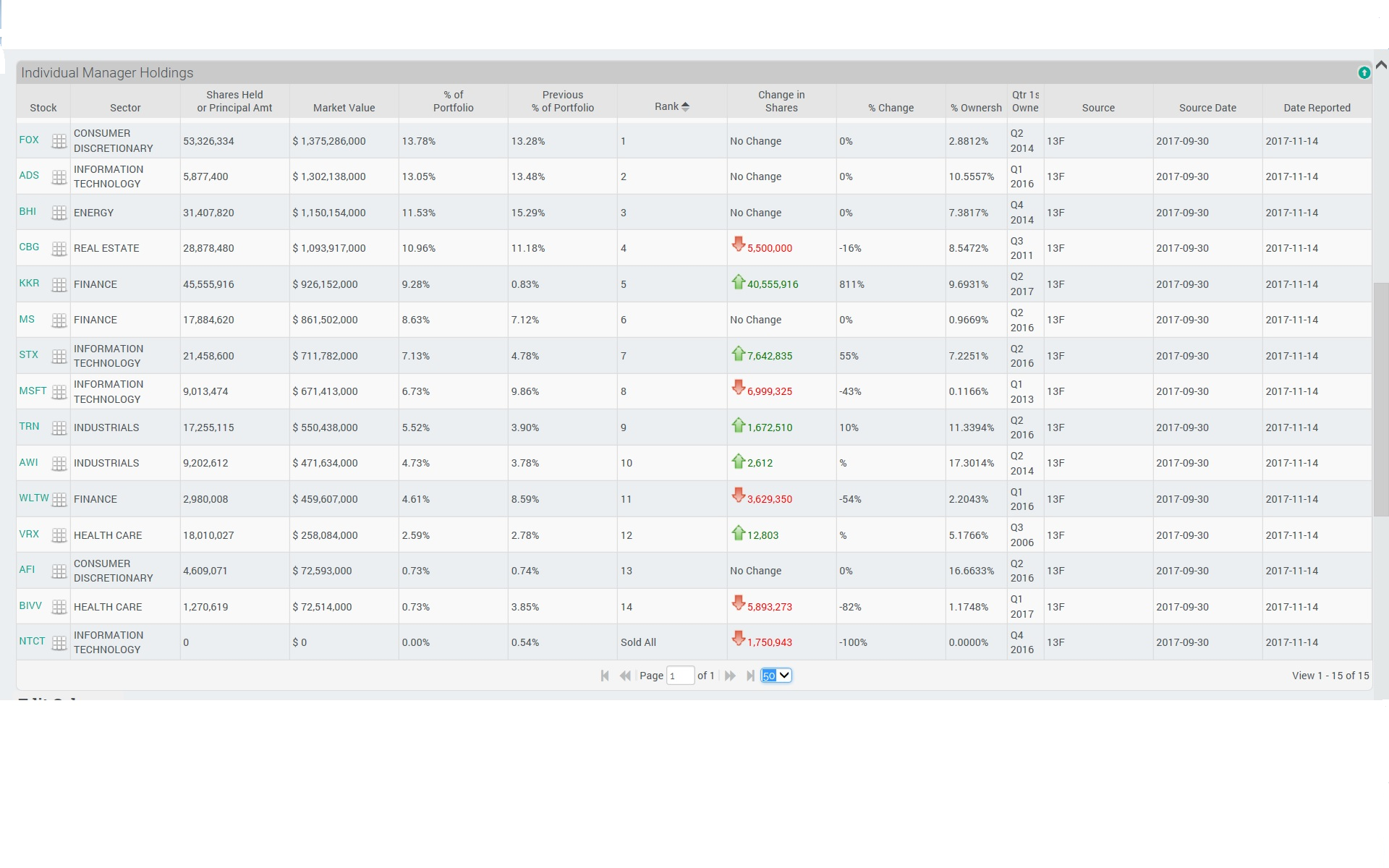

Top 10 in % of total portfolio and average holding time in top 10: ValueAct Holdings. As you can see from the numbers market with a red circle, ValueAct has more than 90% of the assets in their top 10 stock picks, and the average holding period for the top 10 picks is more than 7 quarters. All good signs that this manager is following a long term value investing strategy.

Top 10 in % of total portfolio and average holding time in top 10: ValueAct Holdings. As you can see from the numbers market with a red circle, ValueAct has more than 90% of the assets in their top 10 stock picks, and the average holding period for the top 10 picks is more than 7 quarters. All good signs that this manager is following a long term value investing strategy.