Welcome to my curated collection of the best free tools and resources for analyzing stocks. Many platforms lack comprehensive screening options and robust watchlists with fundamental stock data, but after years of searching, I’ve compiled the most effective ones for you.

These tools offer both free and paid options, but I’ve focused on those with valuable free features. The real magic happens when you combine these resources to extract the most valuable insights for your stock analysis.

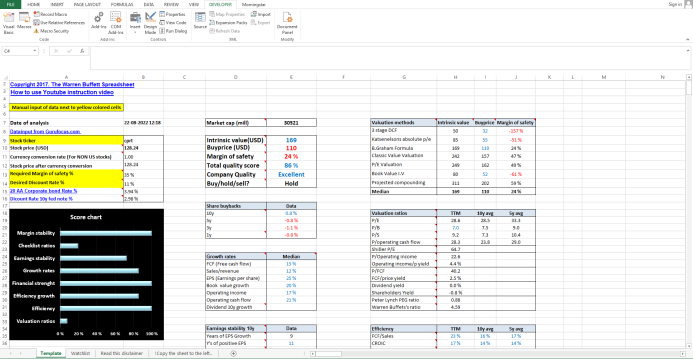

In addition to my own Warren Buffett Spreadsheet, which provides quality scores and intrinsic value estimates, here are the tools I frequently rely on.

If you know of any better free tools and websites for researching stocks in the same categories below, please inform me at warrenbuffettspreadsheet@gmail.com and I will consider it adding it to the list.

Stock watchlists with fundamental data:

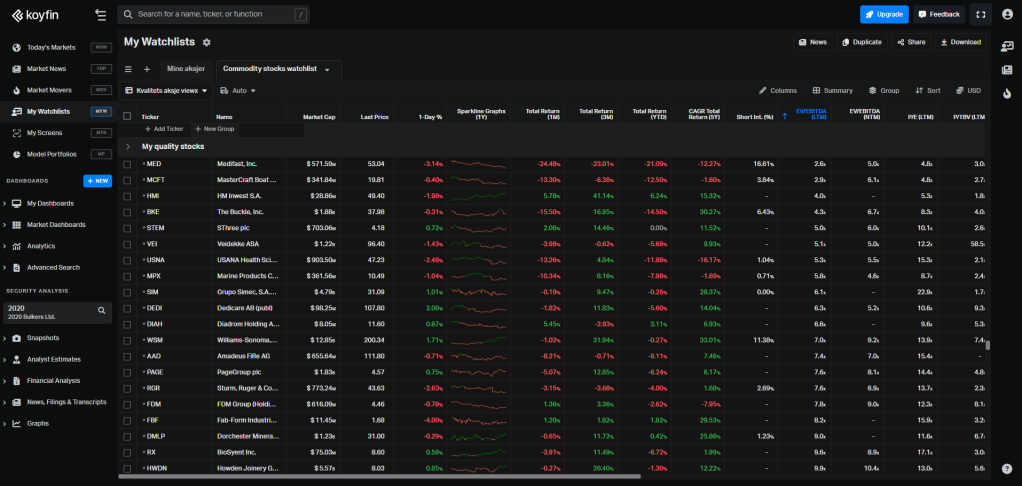

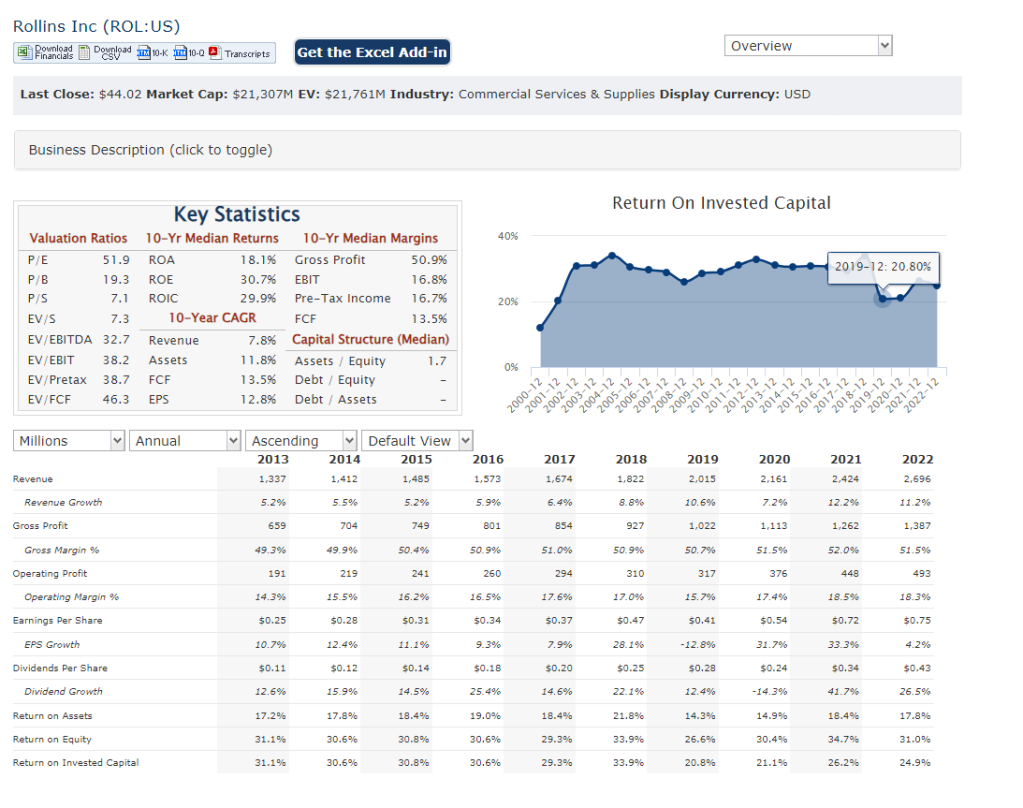

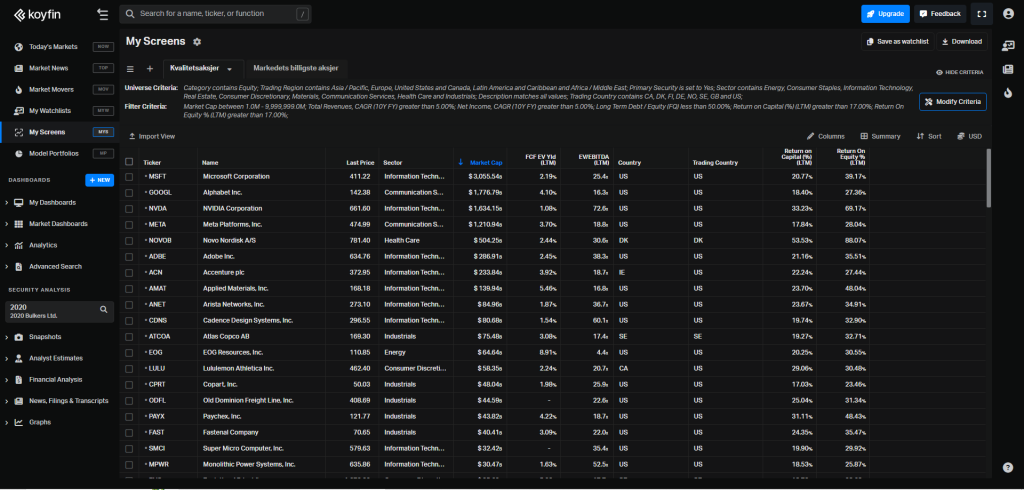

Koyfin – I really like this website because it let me make big watchlist of different sectors and types of stocks. As for now it doesn’t seem like there is any limit to how big watchlist one can make, which is a big plus. Many similar sites have a very limited number of stocks one can put in the watchlist. With the watchlist one can screen a bunch of stocks on different fundamental factors and valuation metrics and get an overview of what is attractive in each sector. In addition they have a good stock screener and a good selection of financial data

Watchlist in Koyfin:

Finchat.io – This page is quite similar to KOYFIN with options for watchlist and fundamental data. They only let you have 30 stocks in your watchlist as of this writing, but they have lots of tools for stock analysis and comparison between stocks. They also have a good stock screener.

Dashboard/Watchlist in Finchat.io:

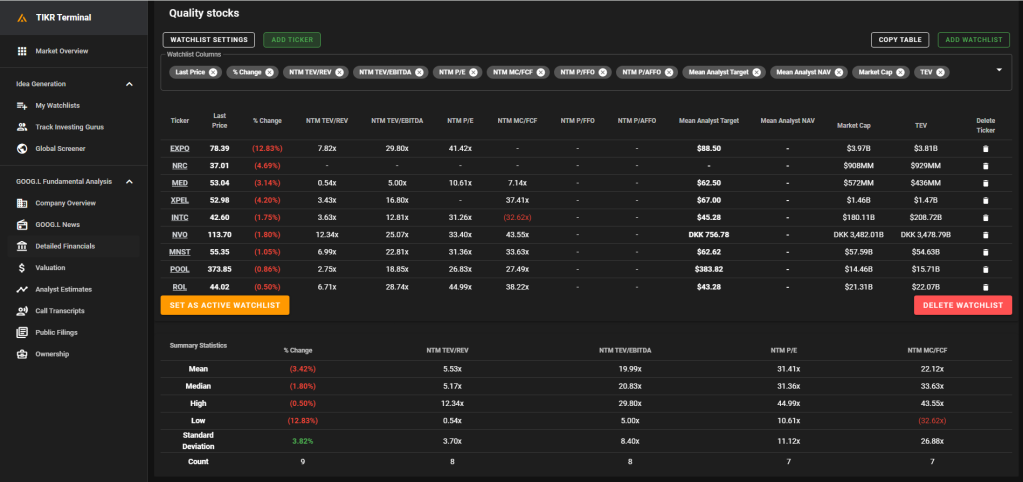

This is also a great website that is similar to the ones above. You can create watchlist and you can get basic financial data on stocks and even read earnings call transcripts. This page also has a good screener, but I prefer Koyfins or Finchats screeners more.

TIKR Terminal watchlist:

J-Stock

This is not a website, but a software that you can install on your desktop and Android phone to make watchlist and look at basic stock charts of your stocks. What I like with it is that its very fast compared to websites and its very easy and quick to add new stocks to your watchlist. There also seem to be no limit on how many stocks you can add to your watchlist. You can upload your watchlist to the cloud and synchronize it between your desktop and android phone. If you like to make stock alerts when stocks fall or reach a certain price this is also a good tool with no limitations on number of alerts. It also have basic technical analysis charting options. I like to make watchlist of quality stocks and also group stocks into categories and sectors.

Watchlist in J-Stock:

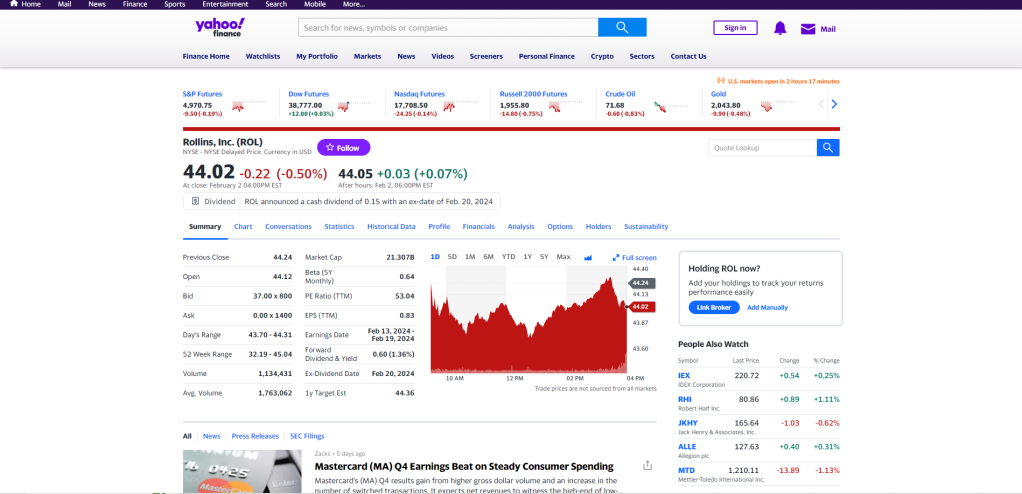

Yahoo Finance: For a quick overview on stocks

I use Yahoo finance to get a quick overview of a stock that I want to check out. You will get quick snapshot of interesting information like valuation, share count, insider ownership, short interest, CEO pay, insider transactions and recent financial data. I use “Summary” “Statistics” “Profile” and “Holders” most frequently.

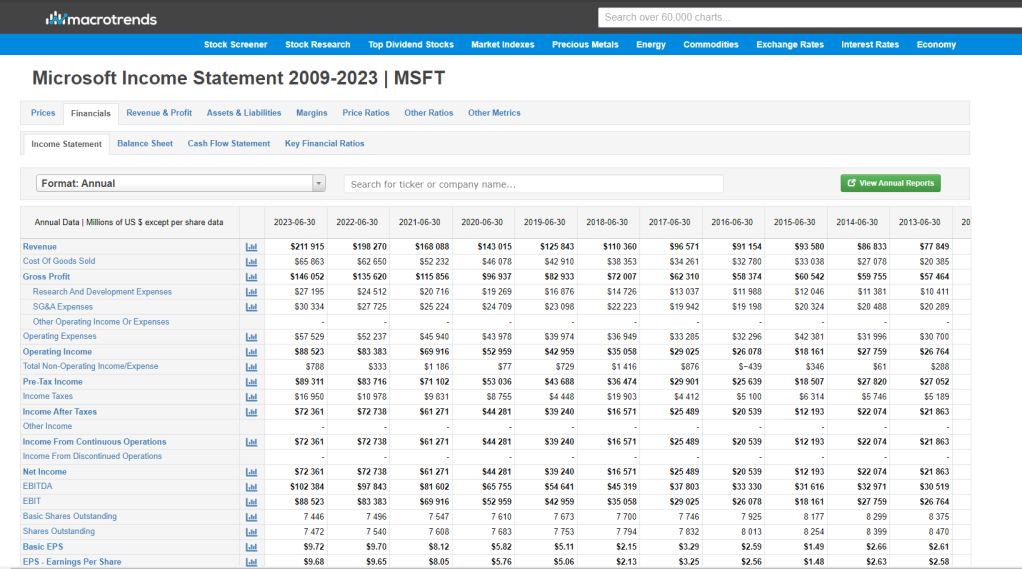

QuickFS – Quick view of 10 years of free financial data

As the name says, with QuickFS you get an quick overview of a stocks past 10 years financial data. They also have quite good coverage of financial data for international stocks

ROIC.AI

10 years of financial data and various ratios for US stocks only.

Macrotrends – 10+years of financial data and key metrics for US-Stocks and many charts with data on the macro.

Best free stock screeners:

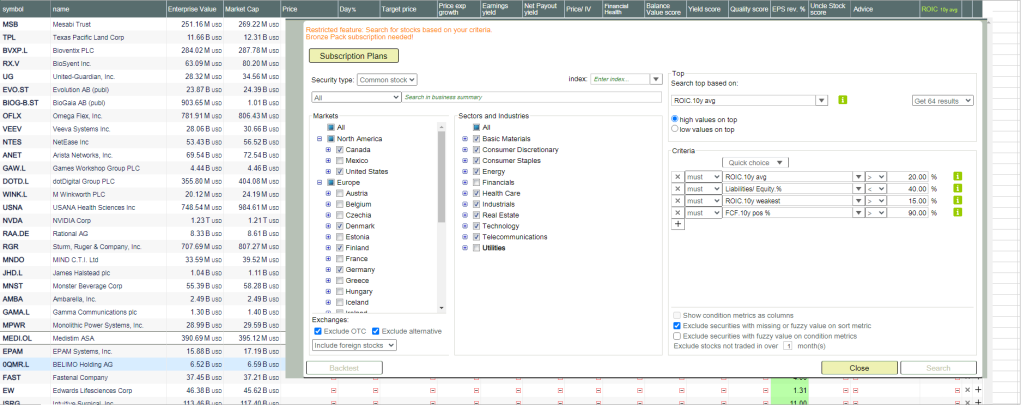

Uncle Stock Screener: This is my favorite stock screener. It has a tons of metrics you can screen for and you can get a big list of the highest quality stocks for further analysis. Even if you don’t get to see much fundamental data with the free version you will get the list of stocks that you can export to other watchlist tools that I have mentioned earlier and get a better fundamental view of the stocks in your watchlist.

Here you can see an example of the criteria’s I have used to get a nice watchlist of high quality stocks:

If you are interested you can download my Excel file with a list of high quality stocks that I found using Uncle Stock:

https://www.dropbox.com/scl/fi/5qqhufqqmw64z68rkknj7/Uncle-stock-high-quality-stocks.xlsx?rlkey=slr8oos1nuzd6z8fe078uvhfg&dl=1

Koyfin Stock Screener:

This screener is great because your screener is saved, so every time you log into Koyfin and go to your screener you get automatically a list of the stocks with your screener criteria’s.

Finchat Stock Screener:

Quite similar to Koyfins screener, but Koyfins screener is slightly better in my opinion with more options for fundamental data in the columns

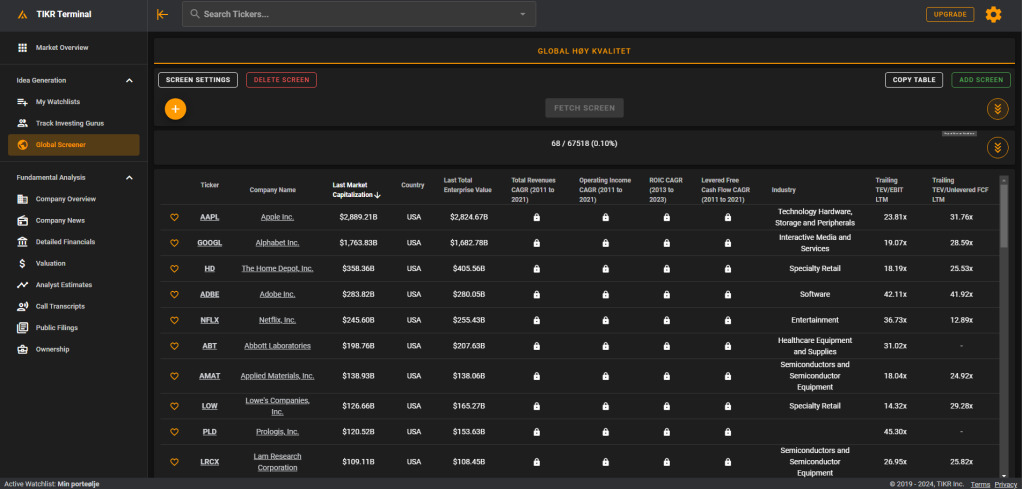

TIKR Terminal Stock screener:

Quite similar to Finchat and Koyfin, but you are only allowed to have 1 screen at a time.

Stock Charting and technical analysis:

Even if I consider myself a fundamental investors foremost, I also do basic technical analysis of the stocks I am interested in.

Tradingview is the best free platform for technical analysis that I have found. It is the most advanced and have the most option I have for charting. I use the free version and I use 50D EMA, RSI and Volume to find a good entry time for my stocks. It’s also good for making trend lines. It also covers all international stocks.

Stcokcharts.com – Quick and easy way to do some basic technical analysis of US-listed and canadian listed stocks:

Stock write ups and analysis:

Value Investors Club (.com) is an exclusive online investment club where top investors share their best ideas. I check this site to see if someone already have made an write up on the stock that I am researching myself.

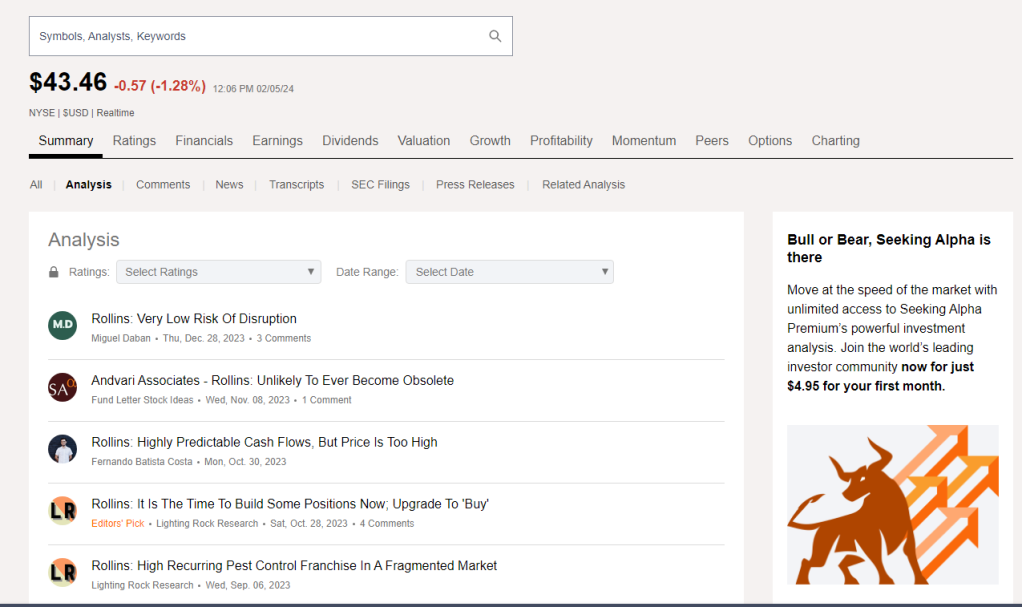

Seeking Alpha – The most popular page for investors to submit their stock analysis. Here you can read write-ups on the stocks you are interested in.

Conference calls and transcripts:

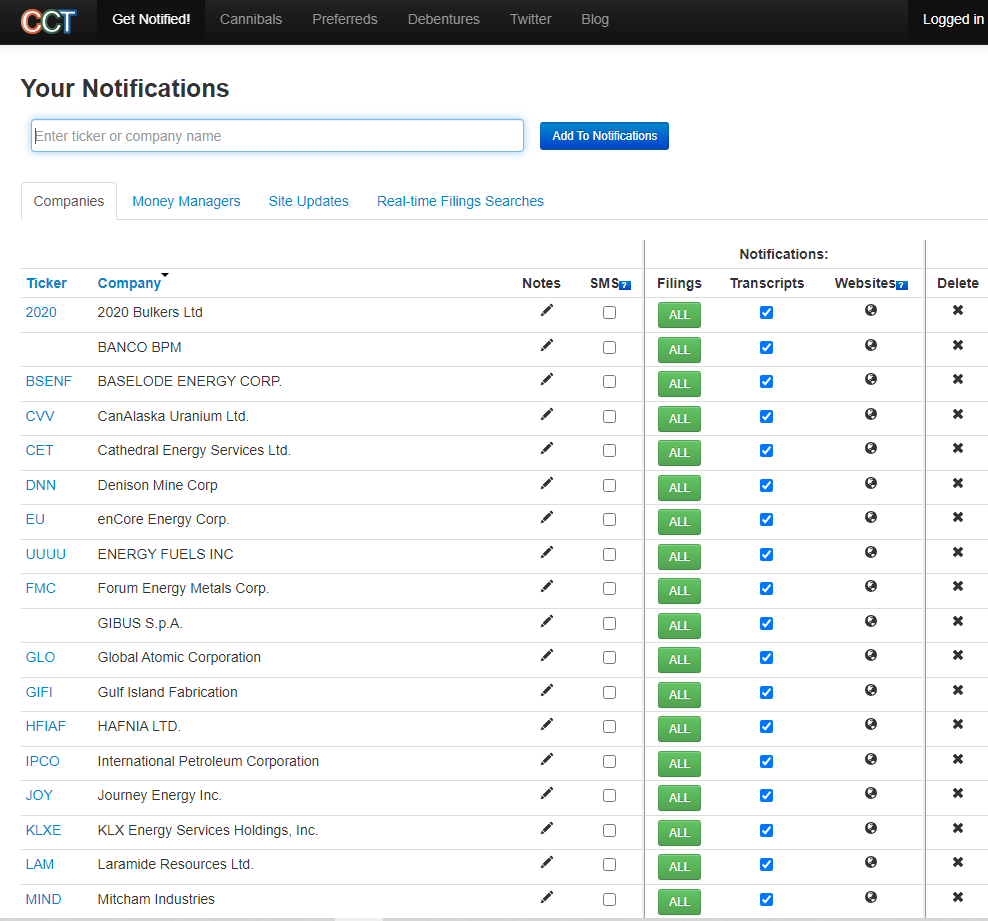

Conferencecallstranscripts

This page is neat because you can get an overview over all the filings for one company, including their conference call transcripts. They also have quite good coverage of international stocks. You can also make a watchlist of the stocks in your portfolio and get an e-mail every time your stocks is filing.

Insider filings:

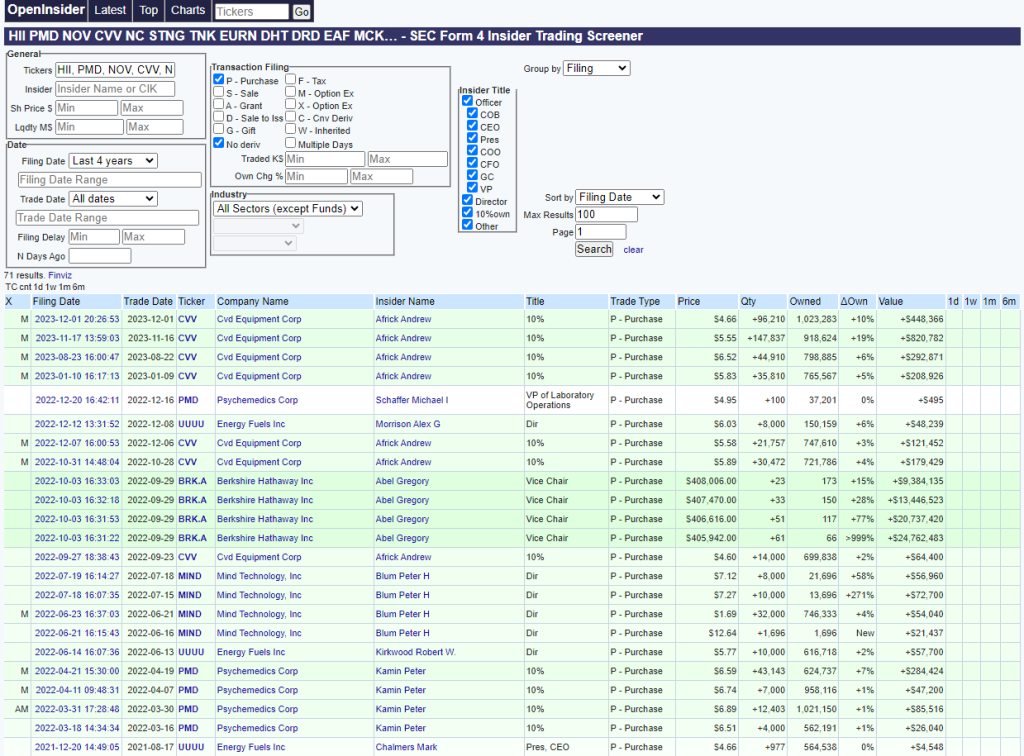

Openinsider – Track the insider buying of US stocks. Tip: You can add several tickers in the search field, separated with a comma and then bookmark the page. Then you can get a summary of all the insider trading for your chosen selection of stocks next time you visit the page.

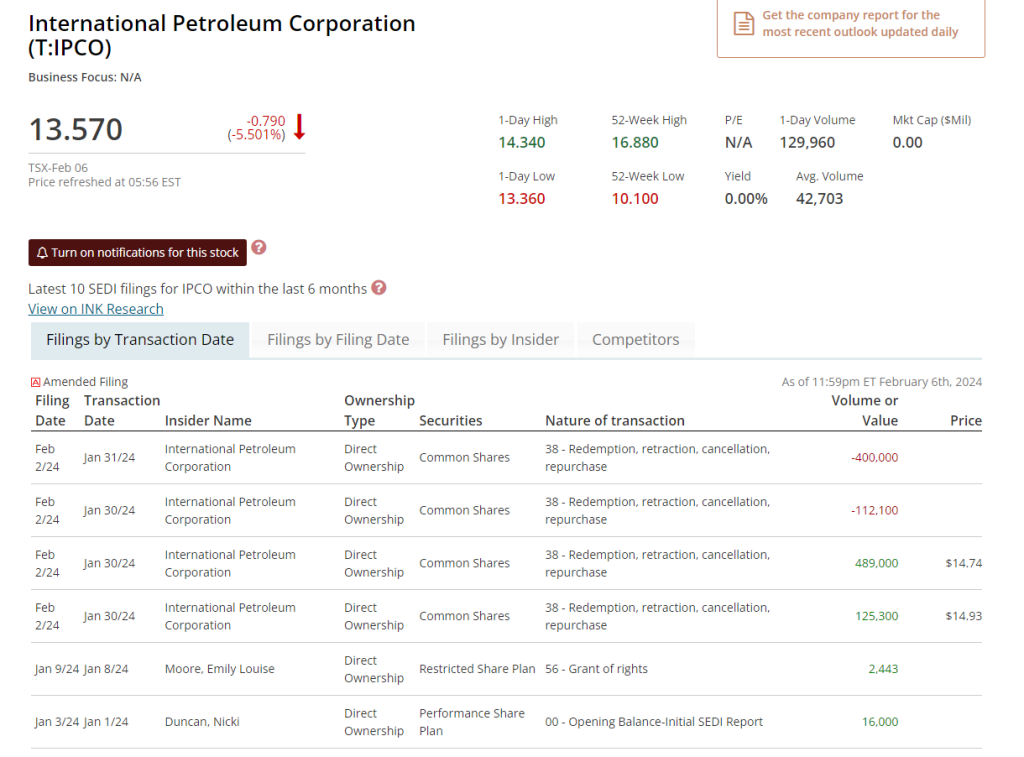

Canadian Insider – Insider trading for Canadian stocks

MISC:

Quartr – This is an free mobile app that lets you get updated on the earnings calls of your companies and let you listen to the earnings call live. You can also download the earnings call for offline listening.

Twitter/X stock search – To keep up date with the news on your stocks you can use Twitters search and do a batch search of tickers that you later bookmark as a website in your browser. Use a $ sign in front of the ticker when you do a search.

Example of a search string: ($pmd OR $nc OR $stng OR $fro OR $dht OR $jin OR $nkr OR $tnk OR $cvv OR $wwib OR $hii OR $drd OR $eurn OR $fcau OR $eaf OR $hii OR $oco OR $mck OR $mind OR $nov OR $ogzpy OR $orrcf OR $tlfa OR $tlf OR $DNN OR $BTU)

After doing your batch search of stocks simply bookmark the page, and then later you automatically get to see the result of the batch search without having to type in each ticker again.

In conclusion, after years of investing and researching stock analysis resources, these free tools offer the most effective and useful features. Most importantly, they provide comprehensive data without overwhelming ads or limitations.

Happy investing!